Shopify Credit

The cashback rewards card for your business

Turn everyday purchases into cashback rewards and reinvest in your business — no credit checks, no annual fees.

See if you’re approved in minutes with no impact to your credit score.1

Why Shopify Credit?

Quickly unlock

new funds

Boost your business cash flow.

Earn cashback rewards

you want

Spend, save, and get rewarded.

No credit checks,

no annual fees

It doesn’t get any simpler than that.

Finally, a business card that works as hard as you

Flex your monthly cash flow with a pay-in-full card designed for your business.

No annual fees

There are no annual, foreign transaction, or card replacement fees.2

Cashback savings

Automatically earn 3% cashback on your top eligible spend category and 1% on others.3

Tailored credit limits

Receive offers based on sales performance that grow with your business.4

No credit checks

Apply with confidence and get a decision in minutes.1 No credit checks, or guarantors.

Multiple cards

Streamline business purchases by giving your team access to their own cards—FREE.

Visa® perks

Pay everywhere Visa® cards are accepted, 99% of US retailers and millions worldwide.5

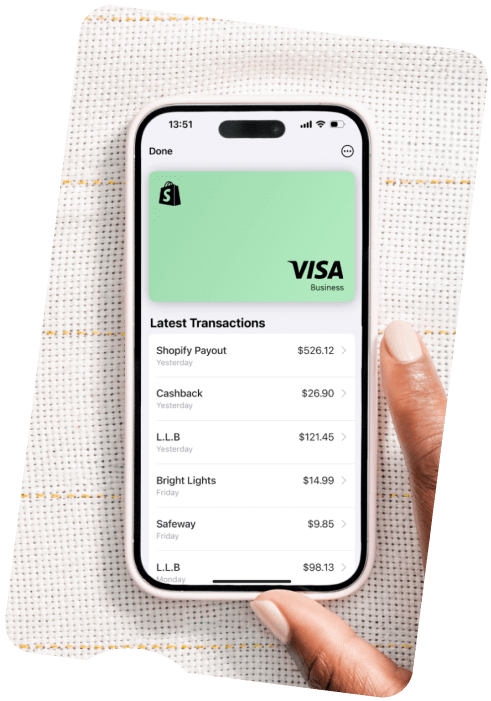

Physical and virtual cards

Get a physical card for all in-person purchases and use your virtual card right away.6

Ordinary business expenses, extraordinary rewards

Get up to 3% cashback on eligible purchases from your top spend category. Plus, earn 1% on the other two with your Visa® business card.3

Marketing

Advertise on Google, Meta, TikTok, Pinterest, Audiences, and with Shopify Email.

Fulfillment

Save on Shopify Shipping, the Shopify Fulfillment Network, Flexport, USPS, UPS, and Stamps.com.

Wholesale

Restock and refresh your inventory with Faire and more coming soon.

Marketing

Advertise on Google, Meta, TikTok, Pinterest, Audiences, and with Shopify Email.

Fulfillment

Save on Shopify Shipping, the Shopify Fulfillment Network, Flexport, USPS, UPS, and Stamps.com.

Wholesale

Restock and refresh your inventory with Faire and more coming soon.

So, what’s the catch?

There is no catch.

Spend on your business.

Earn cashback on eligible expenses—period.

Pay everywhere Visa® cards are accepted, worldwide

Cover business expenses with Shopify Credit and enjoy the Visa® perks you love and expect.

Extended purchase protection

Replace, repair, or get reimbursed if an eligible item is stolen or damaged within the first 90 days of purchase.7

Visa® Zero Liability

Buy with peace of mind. Get built-in protection from fraudulent charges made with your card or account.

Lost or stolen card replacement

Report a lost or stolen card, get an emergency cash advance, or card replacement within 1 day after approval.8

Collision and damage waiver

Get instant coverage for auto rentals, including physical damage, theft, towing, and loss-of-use charges.

Travel and emergency assistance

Access a multilingual call center 24/7 for medical and legal referrals, emergency transportation, and more.

ID Navigator

Stay on top of potential threats to your identity and act quickly if the unexpected happens, powered by NortonLifeLock™.9

Shopify Credit has been the easiest and most straightforward business card I’ve used.

How Shopify Credit works

Spend on your business

Rack up rewards by setting Shopify Credit as your default payment method on Shopify and everywhere else you spend on your business.

Make monthly payments

Pay your balance in full within 25 days after your monthly billing cycle ends to avoid fees.2

Earn cashback rewards

See rewards applied to your account as statement credits each month. We’ll do the math so you don’t have to.

Questions? Learn more about Shopify Credit.

Add more green to your wallet

Your business is already on Shopify.

Now, get rewarded for it with Shopify Credit.

See if you're approved in minutes with no impact to your credit score.1

Resources

Getting started with

Shopify Credit

Learn more about cardholder benefits, how payments work, and get tips on using your new Visa® business card.

Line of credit vs.

credit card

Dive into what makes each of these credit types unique and see what works best for your business.

Business credit cards:

How to choose

Need help picking a business credit card? Get expert advice on evaluating potential credit cards.

Recommended for you

Manage business funds all from Shopify Balance, a free financial account built into your store’s admin.

Apply for founder-friendly capital to power your business. Keep bestsellers in stock, amplify your marketing, and more.

Easily pay, schedule, and manage expenses from the same platform you run your business—free.10

Frequently asked questions

- 1Eligibility is determined by various factors, including business performance, which does not include credit score. Most eligible merchants will receive a decision within minutes, and if approved will receive a virtual card.

- 2The Shopify Credit business card is a pay-in-full credit card. Your statement balance must be paid in full 25 days after the close of your monthly statement period. Any outstanding statement balance will be automatically debited from your designated bank account or Shopify Balance account on each payment due date. If payment fails, your card will be locked and a percentage of your daily sales, up to 20%, will be collected until your balance has been repaid in full. See Issuing Bank Terms for more details on automatic payments and non-payment

- 3"Cashback" refers to rewards earned as a percentage discount on eligible purchases. Earn 3% cashback as a statement credit on up to US$100,000 of annual eligible purchases in your monthly top spend category—either marketing, fulfillment, or wholesale, and 1% cashback thereafter. Earn 1% cashback on the other two spend categories. Restrictions apply. See Rewards Program Terms for details.

- 4 Periodic reviews will be conducted to assess qualification for credit limit increases. If eligible, you have the option to accept the increase at your discretion.

- 5Source: Visa® Fact Sheet

- 6If approved, you will receive a virtual Shopify Credit business card which can be used immediately.

- 7$10,000 maximum per claim and $50,000 maximum per cardholder. Certain terms, conditions, and exclusions apply. In order for coverage to apply, you must use your covered Shopify Credit card to secure transactions. See Visa® Guide to Benefits for more details.

- 8Contact a Visa® Global Customer Care Services associate at 1-800-847-2911, or call one of their toll-free numbers. They will work with you and your financial institution for approval and Visa® will arrange a convenient location for you to collect the emergency cash, or direct delivery of your card to you or a collection location.

- 9To confirm your eligibility for ID Navigator powered by NortonLifeLock™, visit www.cardbenefitidprotect.com.

- 10No subscription fees. Other transaction fees may apply.

Shopify partners with Stripe Payments Company and Celtic Bank for Shopify Credit. Card products are issued by Celtic Bank pursuant to a license from Visa U.S.A. Inc. See Issuing Bank Terms and Shopify Credit Program Terms.